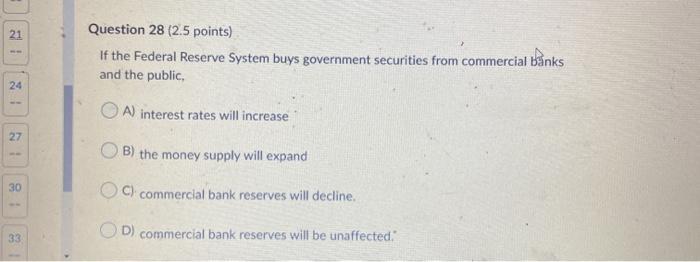

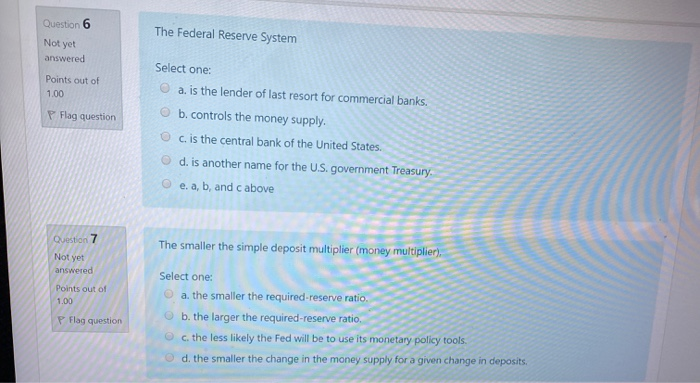

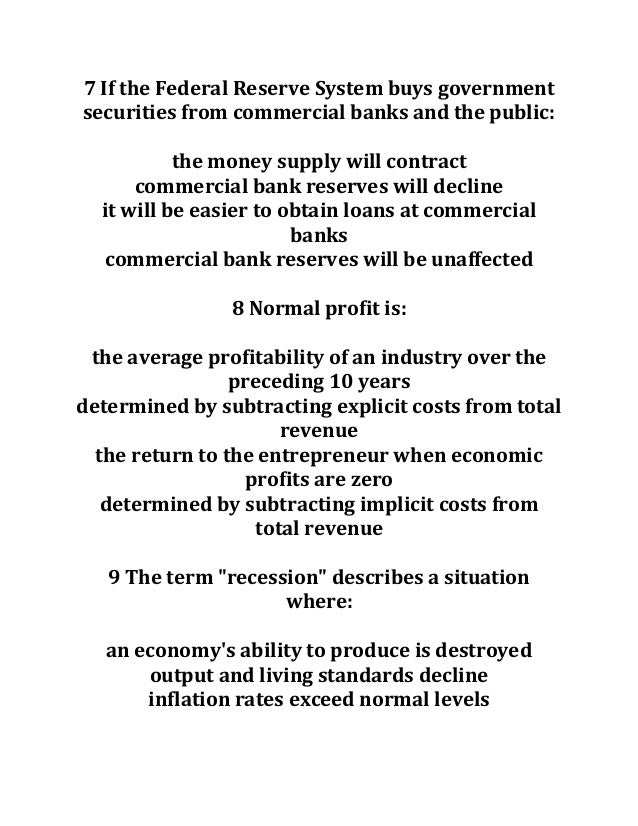

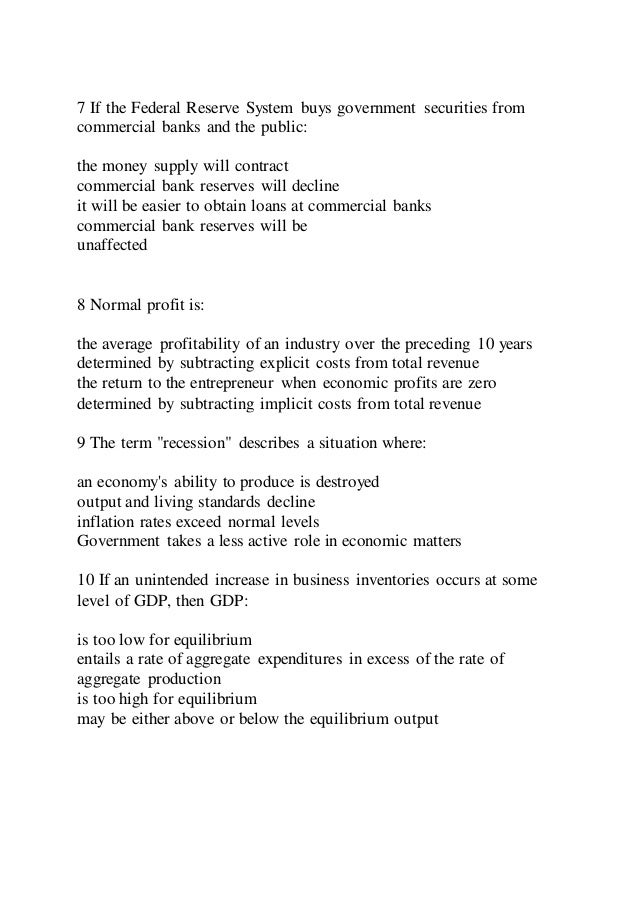

If The Federal Reserve System Buys Government Securities From Commercial Banks And The Public,

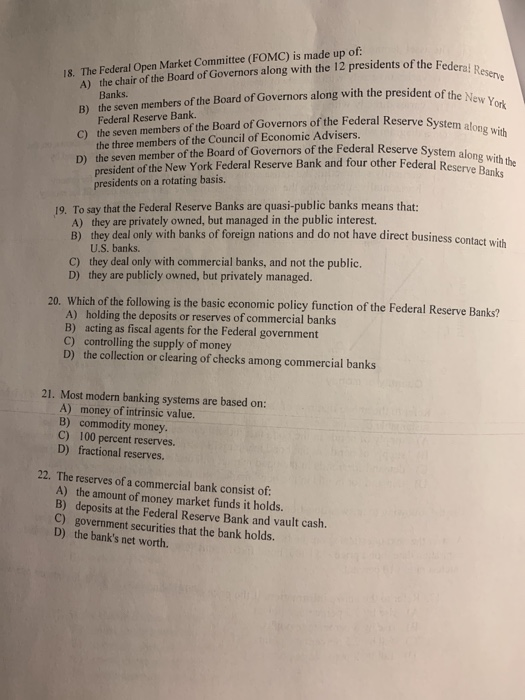

If the federal reserve system buys government securities from commercial banks and the public,. The Federal Reserve purchases Treasury securities held by the public through a competitive bidding process. B commercial bank reserves will be unaffected. Federal Reserve System income is derived primarily from interest earned on US.

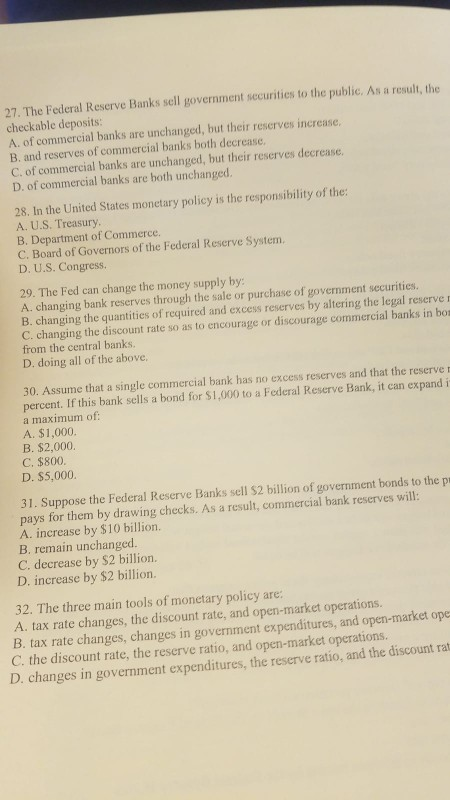

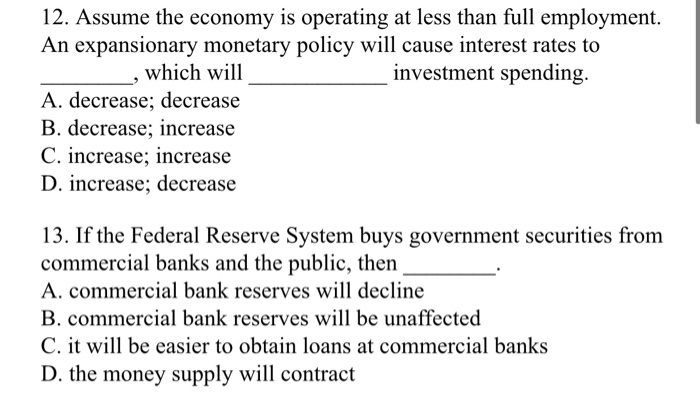

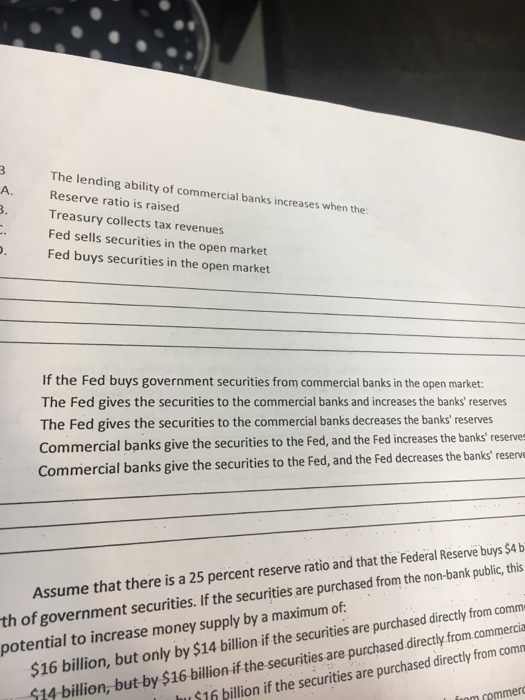

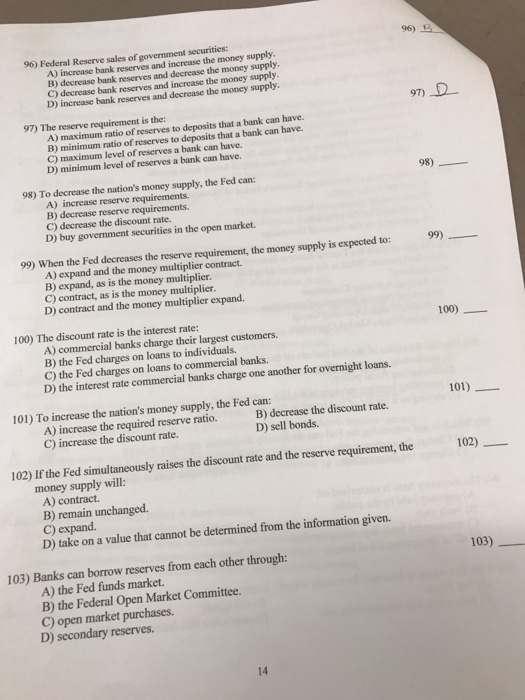

The money supply will contract. The money supply 3. If the Federal Reserve System buys government securities from commercial banks and the public.

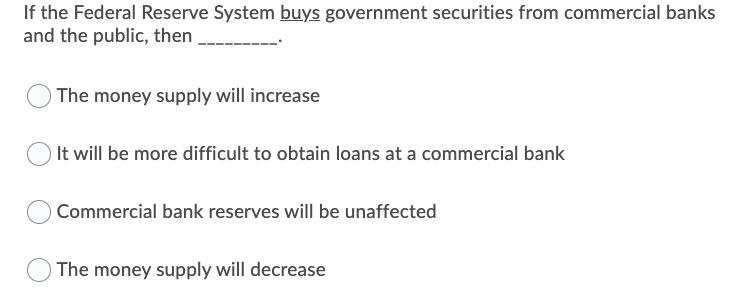

If the Federal Reserve System buys government securities from commercial banks and the public then _____. D the money supply will contract. The Feds power to set reserve requirements was expanded by the Monetary Control Act of 1980.

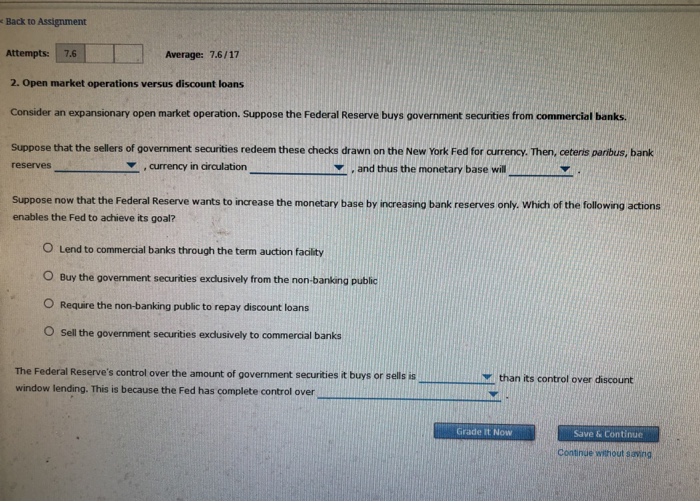

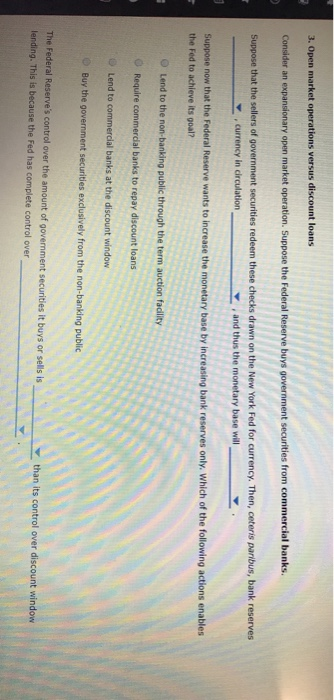

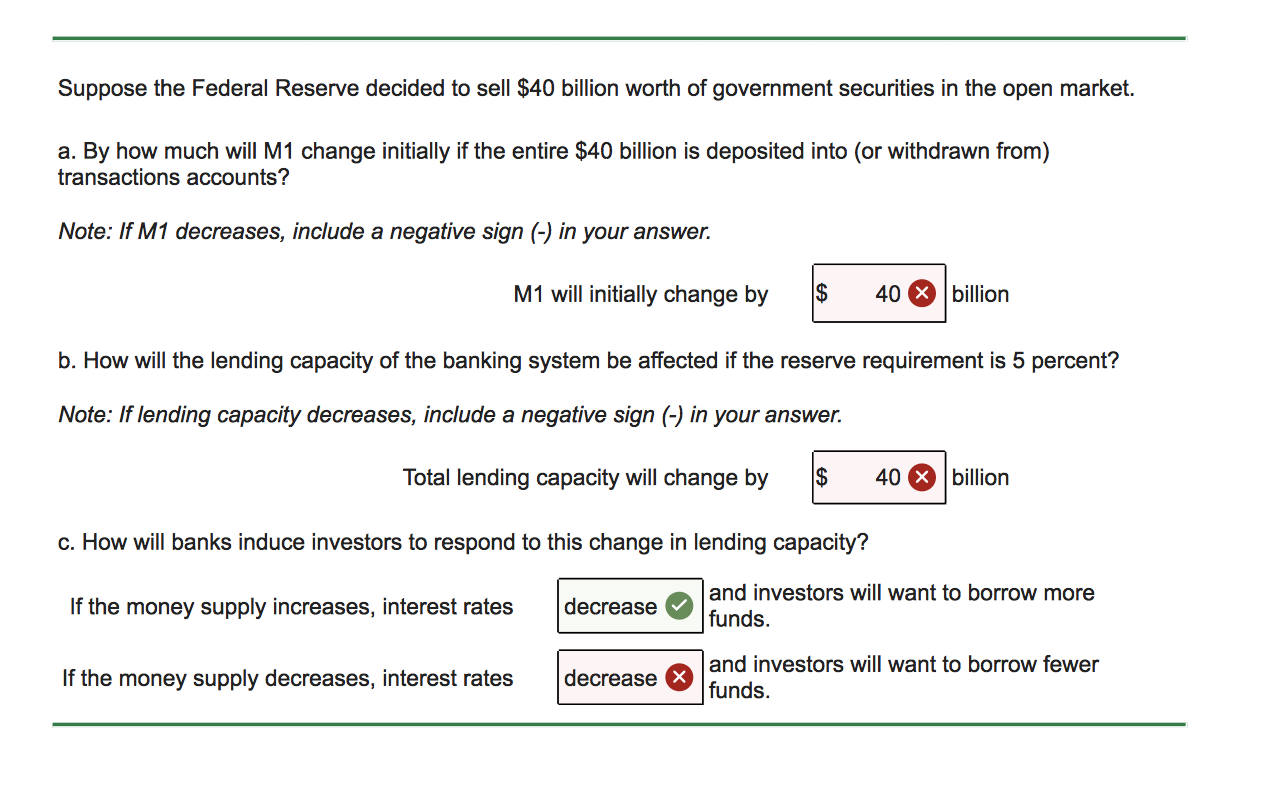

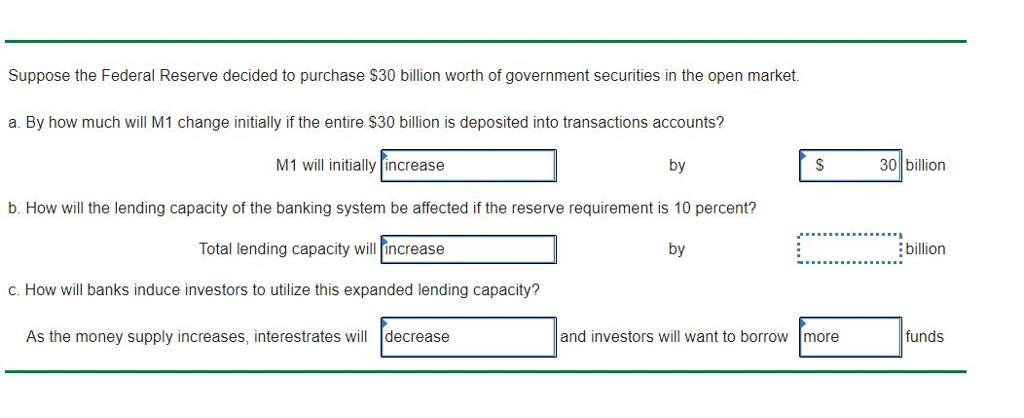

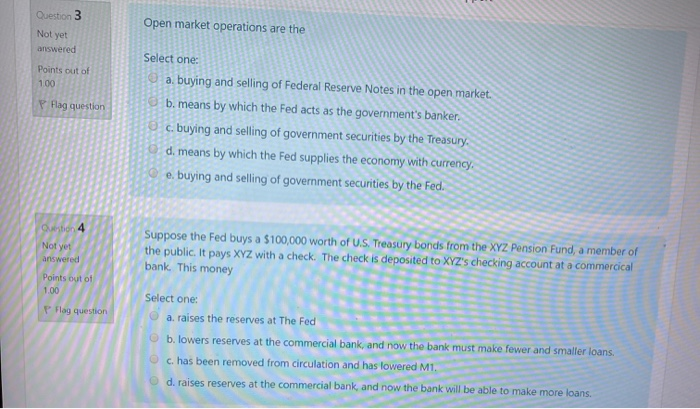

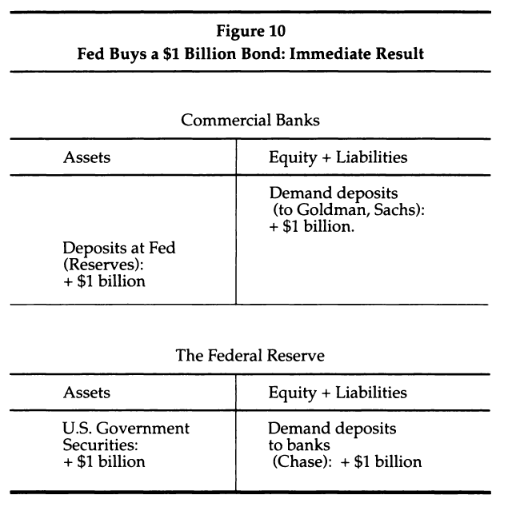

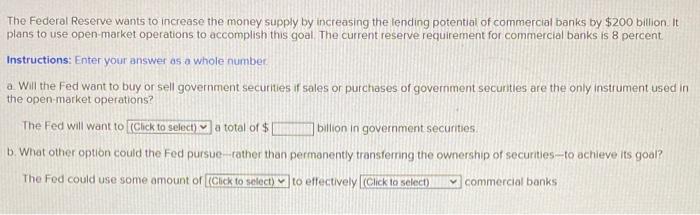

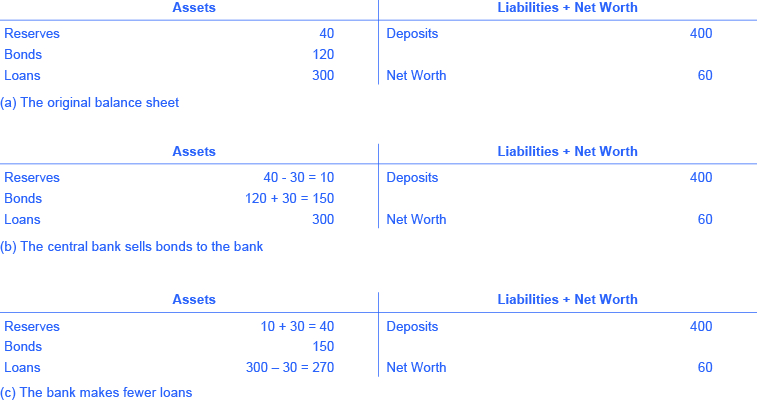

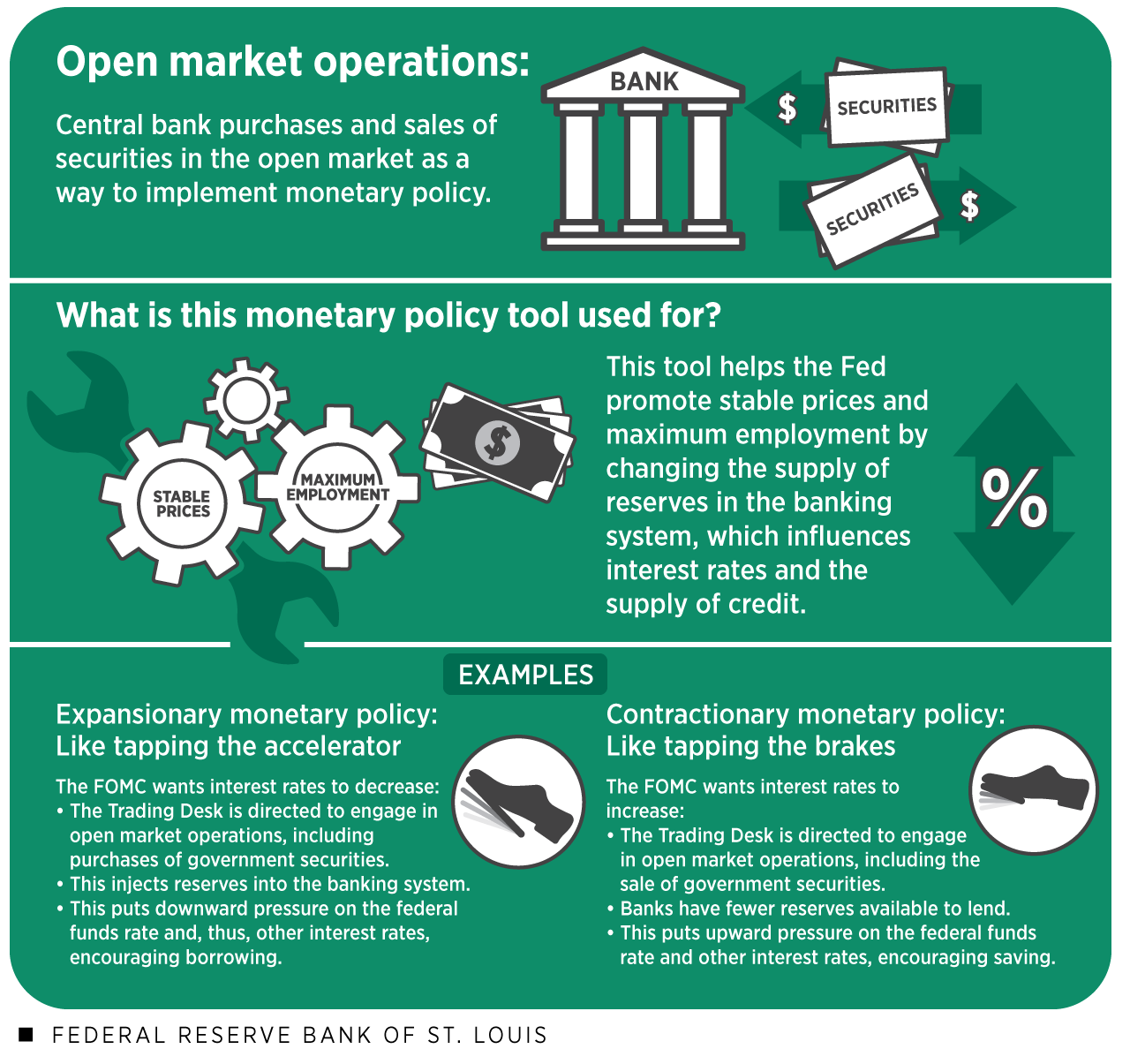

And discount rates which is the interest rate charged by the central bank on the loans that it gives to other commercial banks. To increase the money supply the Fed will purchase bonds from banks which injects money into the banking system. The sale of government bonds by the Federal Reserve Banks to commercial banks will _____.

Bank reserves will not change. Before that the Fed set reserve requirements only for commercial banks that were members of the Federal Reserve System. Banks will be able to make additional loans.

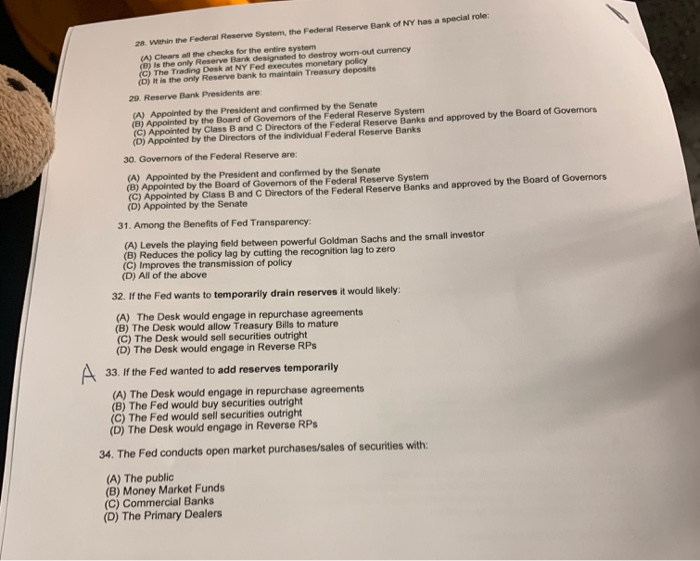

Economics questions and answers. The Federal Reserve buys and sells government securities to control the money supply and interest rates. Commercial bank reserves will decline.

Banks will be able to make additional loans. If the Federal Reserve System buys government securities from commercial banks and the public then The money supply will increase It will be more difficult to obtain loans at a commercial bank Commercial bank reserves will be unaffected The money supply will decrease.

If a commercial bank has no excess reserves and the reserve requirement is 10 percent what.

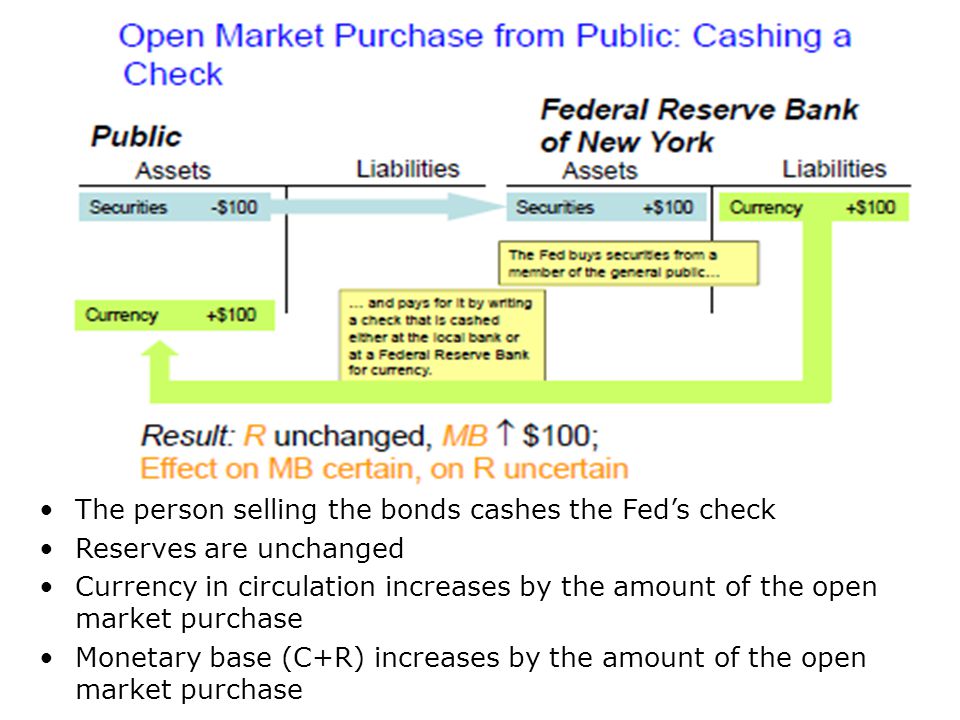

Commercial bank reserves will be unaffected. The Federal Reserve purchases Treasury securities held by the public through a competitive bidding process. Economics questions and answers. D the money supply will contract. Commercial bank reserves will be unaffected. Demand deposits will decrease. If the Federal Reserve System buys government securities from commercial banks and the public A. When the Federal Reserve buys government securities on the open market which of the following will decrease in the short run. To increase the supply of money the Federal Reserve buys government securities from banks other businesses or individuals paying for them with a check.

And discount rates which is the interest rate charged by the central bank on the loans that it gives to other commercial banks. In order to increase the money supply the Fed can. When the Fed buys or sells securities which are almost always Treasuries it buys or sells to one or more of its 18 primary dealers as an open market operation. Open market operations which involves buying and selling government bonds with banks. If the Federal Reserve System buys government securities from commercial banks and the public. As a result of these transactions the supply of money is. The Federal Reserve System has been given a dual mandatepursuing the economic goals of maximum employment and price stability.

/The-federal-reserve-system-and-its-function-3306001_final-7ed205221ee243f0bfa72b8b27226282.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

/GettyImages-487808414-5931fc44ddbc42729f186c3dca88c2da.jpg)

Post a Comment for "If The Federal Reserve System Buys Government Securities From Commercial Banks And The Public,"